Have you thought about the PRC rating in liquid funds? Do you know why it matters and what the matrix represents for these funds?

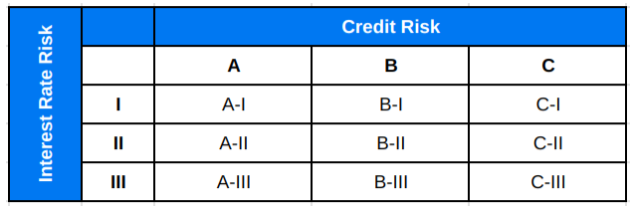

The PRC (Potential Risk Class) matrix, introduced by SEBI, requires debt funds to disclose the maximum level of risk they intend to take in the future based on their current and future investments.

This matrix evaluates two major risks that debt mutual funds are exposed to:

1. Credit Risk – the risk that the issuer of security may default.

2. Interest Rate Risk – the risk of the security’s value fluctuating due to changes in interest rates.

The position of the debt scheme in the matrix shall be displayed by the AMCs by this matrix. Here is have a look at the matrix –

Let me interpret it for you, the Rows I,II and III represent the interest rate risk a fund can take with Row I being the relatively low risk (Macaulay Duration ≤ 1 year), Row II being the moderate risk (Row II: Moderate risk (Macaulay Duration ≤ 3 years) and Row III being the relatively high interest rate risk (Any Macaulay Duration). In the case of liquid funds, investments are restricted to securities with maturity up to 91 days. Because of this short duration, interest rate risk is minimal. Therefore, liquid funds are always placed in the Row “I” category, indicating relatively low-interest rate risk.

However, the PRC rating still matters because liquid funds can differ in credit risk, depending on the type of short-term instruments they choose—ranging from very high-quality (AAA rated) securities to slightly lower-rated ones. Category ranges from columns A to C represents the credit risk a fund is willing to take, Column A being the lowest and Column C being the highest.

SEBI has assigned a Credit Risk Value (CRV) to different categories of debt securities. The higher the CRV, the lower the potential credit risk—and vice versa.

· Government securities (G-Secs), State development loans/Treasury Bills/ Repo on Government Securities/TREPS / Cash carry a CRV of 13

· AAA-rated securities have a CRV of 12

· AA+ securities have a CRV of 11

· AA securities have a CRV of 10 and so on

Classification based on the weighted average CRV of a fund’s portfolio:

· CRV ≥ 12 → Classified as “A” class (relatively low credit risk)

· CRV of 10–11 → Classified as “B” class (moderate credit risk)

· CRV < 10 → Classified as “C” class (relatively high credit risk)

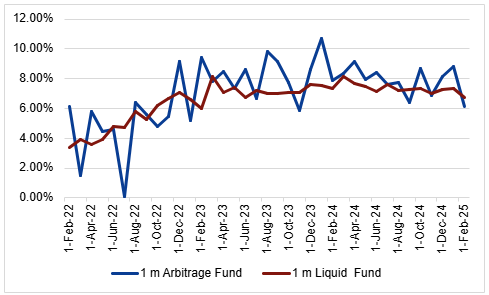

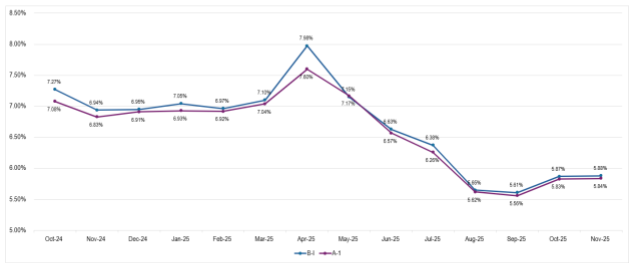

Although moderate credit-risk funds should theoretically outperform low credit-risk funds on a risk-adjusted basis, the performance differential has meaningfully narrowed over the past one year. This trend has been influenced by improved market flows, compression in credit spreads, and a strategic tilt among fund managers toward lower credit-risk instruments.

Median Rolling returns of PRC A-I vs B-I Liquid Funds

Source: ICRAMFI360, PPFAS Research

The spread between median rolling returns of A-I and B-I rated liquid funds has been reduced over the past year with better liquidity conditions since April 2025. A fund that takes higher credit risk may offer slightly higher returns but with increased potential volatility or credit events. Since liquid funds are designed primarily for short-term goals and emergency requirements, safety and liquidity should be preferred over returns.

Disclaimer – The views are personal. Macaulay Duration (Duration) measures the price volatility of fixed income securities. It is often used in the comparison of interest rate risk between securities with different coupons and different maturities. It is defined as the weighted average time to cash flows of a bond where the weights are nothing, but the present value of the cash flows themselves. It is expressed in years/days. The duration of a fixed income security is always shorter than its term to maturity, except in the case of zero-coupon securities where they are the same. The Potential Risk Class (PRC) matrix, mandated by SEBI, discloses the maximum interest rate and credit risk a debt scheme may assume. PRC classification provides transparency on permissible risk boundaries but does not guarantee safety, liquidity, or returns. Past performance, including the mentioned narrowing of return differentials between A‑I and B‑I liquid funds, is not indicative of future results. Investors should evaluate their objectives and risk tolerance and consult the respective Scheme Information Document (SID), Key Information Memorandum (KIM), and professional advisors before investing.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.