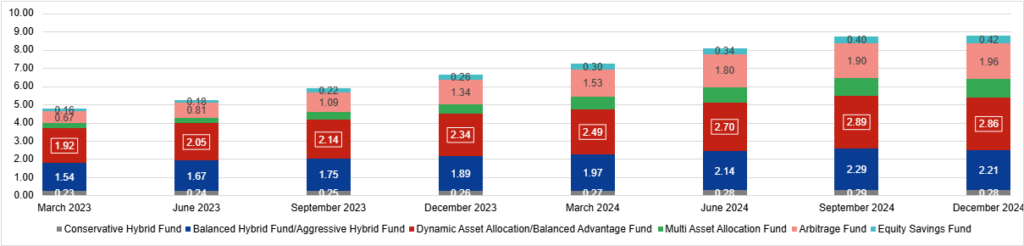

Since March 2023, the category of hybrid funds has witnessed a significant surge in assets under management (AUM), almost doubling. This is largely due to the favorable tax treatment of certain hybrid fund types and their ability to offer diversified exposure across different asset classes.

Source: Hybrid Fund AUM (Rs Lakh crore)(AMFI Data)

The rise in popularity of Dynamic Asset Allocation funds, Balanced Advantage Funds , Multi-Asset Allocation Funds, and Equity Savings Funds can also be seen as part of a broader trend where investors are increasingly seeking tax-efficient, diversified investment strategies, especially in the current volatile market environment.

However, investors often make mistakes when selecting these hybrid funds, primarily due to a lack of alignment with their individual risk profiles, financial goals, and other critical factors. Here’s a closer look at some of the common mistakes investors make when choosing hybrid funds and how they can avoid them:

Overestimating Stability and Underestimating Volatility :

Some investors mistakenly believe that hybrid funds, due to their diversified nature, are always low-risk. While hybrid funds are less volatile than pure equity funds, they can still experience significant fluctuations.

A Balanced Advantage Fund /Dynamic Asset Allocation Funds might have a large allocation to equities, which could lead to substantial volatility in bear markets. If an investor expects consistent returns, they could be caught off guard during periods of market downturns.

It’s important for investors to understand that while hybrid funds are designed to reduce volatility compared to pure equity funds, they are not completely risk-free. They can still be impacted by market corrections, interest rate changes, and other macroeconomic factors

Ignoring Fund Strategy and Asset Allocation:

Focusing too much on past returns without understanding the underlying asset allocation strategy of the hybrid fund can lead to poor decision-making. The asset mix and how actively the fund manager adjusts the allocation based on market conditions are crucial factors in determining the future performance of a fund.

Always check the fund’s investment philosophy and asset allocation strategy. This gives a clearer picture of what to expect from the fund beyond just past performance.

Time Horizon:

Hybrid funds, which invest in both equity and debt instruments, typically experience higher volatility than debt-only funds. As a result, these funds are better suited for medium to long-term investment horizons. While they aim to balance risk and return by adjusting the equity and debt allocation, hybrid funds are not immune to short-term market volatility.

For investors with a shorter investment horizon, liquid funds or arbitrage funds are more appropriate.

Comparing one fund with another:

One of the unique characteristics of hybrid funds is their flexibility to allocate between equity and debt based on the fund manager’s strategy and prevailing market conditions subject to SEBI MF Regulations. This flexibility means that hybrid funds are not directly comparable to each other in the traditional sense, especially when compared to more straightforward equity or debt funds.

A Dynamic Asset Allocation Fund may hold a higher percentage in equities during a bull market, while another may hold a lower percentage. Some hybrid funds have a higher equity exposure, targeting more aggressive growth over the long term. Others may maintain a lower equity allocation and balance with arbitrage opportunities, focusing on capital preservation with some growth potential.

The type of debt instruments used in a hybrid fund (e.g., government bonds, corporate bonds, or money market instruments) also affects its risk and return profile. A fund investing in higher-rated bonds will typically have lower risk and lower returns, while one investing in lower-rated bonds could have higher returns, but with a corresponding increase in risk.

Because of the flexibility in asset allocation and different investment strategies, hybrid funds are not easily comparable. When evaluating these funds, it’s important to focus on the investment objective, risk tolerance, time horizon, and management style rather than just comparing them based on past returns or a single performance metric. Each hybrid fund is designed to meet specific investor needs, and understanding the underlying strategy is key to making an informed decision.

Disclaimer: Views expressed herein are personal in nature and cannot be construed to be a decision to invest