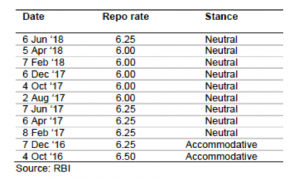

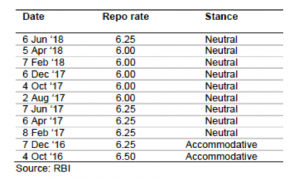

On 6th June 2018, the Monetary Policy Committee (MPC) of RBI increased the repo rate by 25 bps to 6.25% after nearly 4 years. Interestingly, the vote to hike as well as the magnitude of hike was unanimous. In the last MPC meeting, there was only one member of the MPC who had voted FOR the rate hike.

Despite the RBI projecting a neutral outlook on future inflation, it remains a worrying prospect. Consequently, we have to grapple with the rather uncharacteristic dichotomy between the RBI’s words and its recent action.

Increased crude (oil) basket prices…and the attendant negative impact on transportation costs are pointing to a rise in expected CPI inflation as suggested by the RBI Governor.

RBI has already increased the inflation targets for H2 of FY19 from 4.4% to 4.7%. Core CPI inflation (ex-food and fuel prices) has crossed the RBI upper-bound of 6% after a long time, and shows signs of remaining elevated.

Impending US Fed. rate hikes may also put the Indian Rupee under pressure and further exacerbate the inflationary environment.

Globally as well, growth has picked up – and impending trade wars notwithstanding – could eventually lead to higher headline inflation and further test RBI’s resolve to maintain inflation within the much-publicised corridor of 4% +/- 2%.

Lastly, don’t forget 2019 is an ‘Election year’ for India and history has shown that such years usually increase the pressure on the ‘fisc.’ and spur inflation.

So, what should you expect post the latest hike?

- With 10 year G-sec yield crossing 8% , the cost of funds is set to rise

- Home loans will become more costlier

- You will earn more on your fixed deposits and liquid funds

- With fixed deposit rates becoming more competitive, we could see mutual fund inflows slowing down a bit.

Given this backdrop, I would stick my neck out and predict that the RBI will announce one more rate hike in the next two MPC meetings this calendar year.