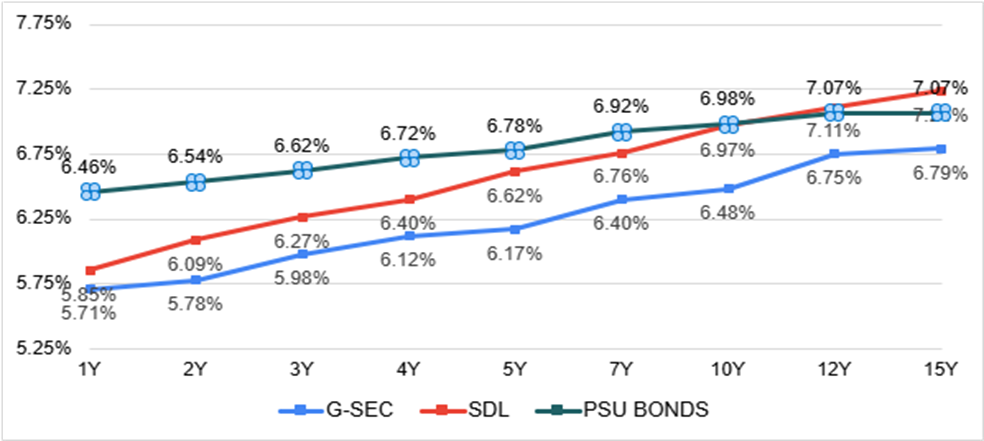

Corporate bond yields attracted strong investor interest up to July 2025, with record-high issuances being comfortably absorbed by the market. Spreads remained attractive relative to State Development Loans (SDLs). Backed by the RBI’s liquidity easing measures and a cumulative 100 bps of rate cuts in CY2025, overall liquidity conditions have turned comfortable. Corporate bonds continued to offer appealing spreads as investors sought to lock in higher yields amid expectations of further rate declines. Notably, the corporate bond curve, which had remained inverted last year amid liquidity deficit conditions, has now steepened in line with improving market dynamics.

Bond Yield Curve (31st July,2025) Source: CCIL (Yields are annualized)

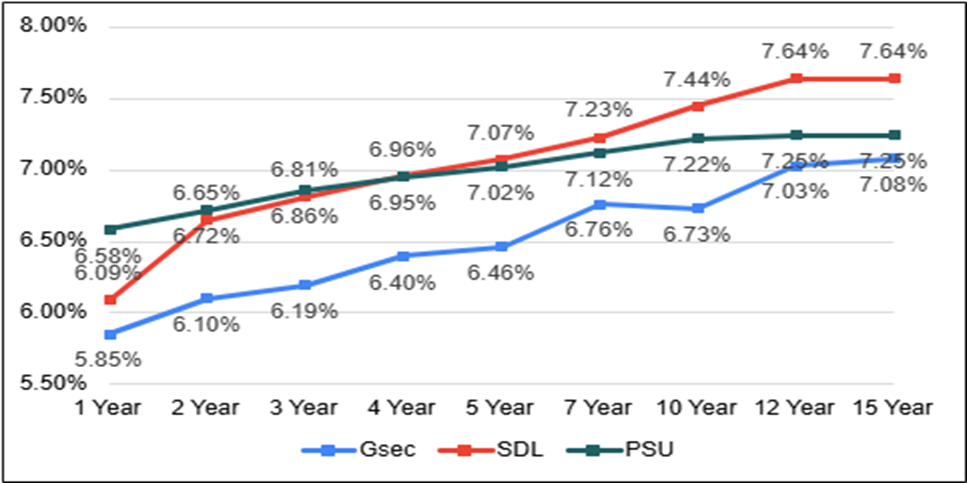

Following the August 2025 monetary policy meeting, a more cautious tone has emerged. Fiscal concerns linked to GST reforms, tariff-related announcements, and subdued bank demand have driven yields higher across G-Secs and SDLs. Elevated state borrowing has also added pressure, with issuances in FY25 (up to 15 August 2025) rising to Rs 3.80 lakh crore compared to Rs 2.53 lakh crore in the same period of FY24. As a result, SDL spreads over G-Secs have widened sharply to 70–80 bps, well above their usual 45–50 bps range. Lower participation from insurance and pension funds—particularly at the longer end, where they typically dominate—has further contributed to the steepening.

In contrast, corporate bond issuances remained muted in August 2025 as issuers refrained from locking in debt at elevated interest rates. A few attempted issues were eventually withdrawn amid higher investor bid expectations. The combination of elevated SDL yields and subdued corporate supply has driven a sharp compression in AAA PSU corporate bond spreads over the past month. While the PSU corporate bond yield curve remains steep, spreads have narrowed considerably—turning unattractive beyond the 2–3-year segment, where they have even slipped into negative territory. The government bond yield curve including SDLs has now turned more attractive, with unusual spreads emerging from the recent steepening. However, given these unusual circumstances, the expectation is that the RBI to intervene and stabilize the market through appropriate measures.

Yield Curve (26th August ,2025) Source: CCIL (Yields are annualized)