The overall Healthcare sector, specially Hospital industry has continuously seen rise in acquisitions with various deals by private equity firms. More and more hospital chains are acquired by foreign private equity firms.

Why there is so much surge of deals in India’s healthcare sector. These private equities firms own majority stake in some of the hospital chains. What it means for patients ?

Let us first try to understand what a private equity firm is ?

Private equity (PE) is a form of equity capital that prefers investing in fast paced growth companies at an early stage predominantly in unlisted companies. Private equity has several characteristics that distinguish it from other forms of investment. Some of this includes Long term investments, illiquidity, high expected returns, active management, exit strategies etc. These characteristics make private equity a special and often lucrative form of investment, but one that is also associated with considerable risks and challenges.

Deals in Private equity

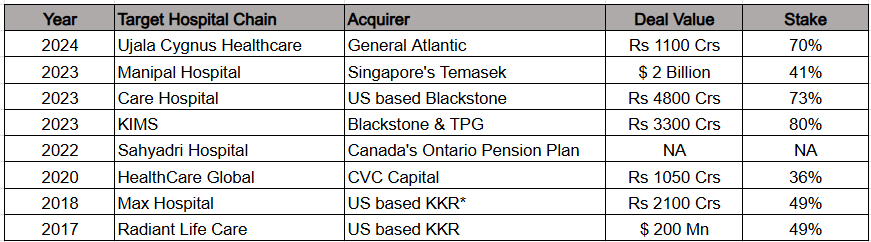

As per various sources, Year 2023 alone saw PE firms investing $ 5.5 Bn in Indian Healthcare industry. Some of the past acquisitions include :

* Acquired by Radiant Life Care owned by KKR

The PE firms provide a fresh air of capital infusion for hospital chains to expand rapidly, open new facilities as well as upgrade the existing facilities. The strategy adopted by PE firms is such that they like to take control of company’s operations and management. They seek out companies with high growth potential or those needing significant operational improvements. Once they find suitable investment, they inject fresh capital. The goal of the PE firm is to increase the value of the company usually between 5-7 year period.

After enhancing company’s performance and growth, the PE firm will eventually sell its stake through various exit strategies by way of sale to another company or through public offering (IPO). Typically the PE firm do not stay for long term.

Hospital bed per 1000 population is a metric often used to assess access to healthcare facilities in the country. India has 0.60 hospital bed per 1000 population as per the ministry of health in 2021. In contrast studies indicate 3 hospital bed per 1000 population is close to idle. This means there is a huge gap in access to healthcare services in India there aren’t enough hospitals or medical professionals in the system to take care of India’s rising population. This gap was one of the major reason why our healthcare system literally collapsed during covid pandemic. PE deals in Indian Healthcare space has actually shot up after pandemic

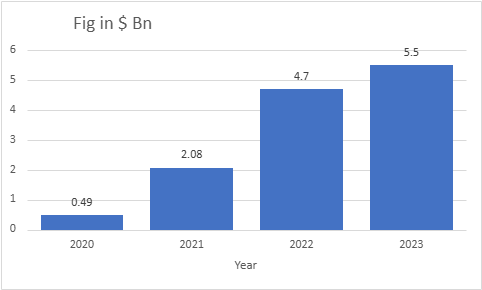

Below chart highlights PE investment in Indian Healthcare space annually since Year 2020

Source : Bain Capital

Global investors are seeing the gap in Indian healthcare infrastructure as an opportunity for them. Also with rising bill of surgeries, insurance penetration and lifestyle chronic disease – all this factors are expected to boost hospital revenues.

The top 10 healthcare chains in India on the private side would still account for less than 5% of total hospital beds, resulting into a fragmented industry. While large chains are growing faster, there is still a huge runway for inorganic growth.

Impact on the industry :

The immediate impact is the rapid expansion of this chains with fresh inflow of funds. The hospitals are able to open new facilities and upgrade their existing facilities to enhance the services provided. However PE Firms are here for quick spurt of growth where they can actually make profit and exit. However this may not board well for patients as PE firms focusses on profit with emphasis on maximising returns leading to higher healthcare costs. PE firms have bad track record in international healthcare industry including USA. Some of the same PE firms are buying out hospitals in India.

Based on global hospital industry phenomenon, these hospital chains have set such high standards of protocols that small hospitals won’t be able to meet. Eventually, the micro health system will vanish and only the large corporate chains will be left. Ultimately the burden shall fall on the patients. Many often patients suggest that once a hospital chain is acquired by these PE firms their hospital bill has gone up by 15-20% including consultation fees.

On the other hand increasing PE in Indian healthcare could also mean that India can become better integrated with global healthcare industry, and become a regional/global hub for quality medical care, medical tourism related opportunities etc. If anything goes south with Indian healthcare/hospitals, PEs alone will surely not be the reason for it. PEs only respond to ‘market opportunities’ and maximize their returns.

Performance improvement and Exits :

CVC Capital made investment in Healthcare global in 2020 since then the cash flow from operations has jumped to ~ Rs 300 Crs from being less than Rs 100 Crs, market cap since 2020 has more than doubled. Similarly Max Healthcare has seen its market cap rise by 5x since 2018 when KKR alongwith Radiant invested Rs 2100 Crs for 49% stake. EBITDA Margins for Max Healthcare improved from ~10% in FY19 to 27% in FY23. Care hospitals saw its EBITDA rise from Rs 98 Crs in FY18 to Rs 323 Crs in FY23.

One of the most successful exits in Hospital space was KKR cashing out 5x returns when it exited Max Hospitals in 2022 in just 4 years timeframe, the most lucrative since the PE firm started investing in healthcare space. Other notable exits in the space include Carlyle exiting Medanta, Everstone exiting Sahyadri Hospitals etc

References:

FOF talk on Overview of Hospital Industry in India – https://youtu.be/6_CWubvfQVU?si=-pHqufIytXHYZa6Z