“Arbitrage” is when one simultaneously purchases and sells the same security in different markets to profit from unequal prices. Arbitrage Funds are schemes that invest a minimum of 65% of money in equity stocks and hedge them with corresponding sale of a futures contract, thereby earning a risk-free arbitrage yield when the positions are held till maturity. However, at every given point of time, the spread between the security so purchased and the future contract so sold keeps changing resulting in volatility on returns at that point of time. Yes, the balance of up to 35% can be invested in Debt securities & Money Market Instruments, however the same differs from scheme to scheme.

As against arbitrage, “Liquid” represents being flexible. Liquid Fund schemes primarily invest in money market securities such as treasury bills, commercial papers, certificates of deposits, etc. having a maturity of not more than 91 days.

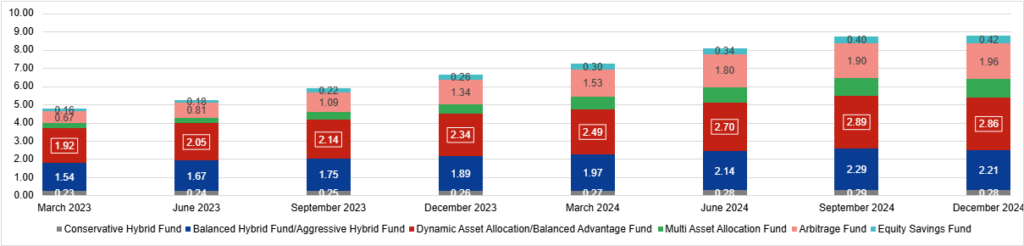

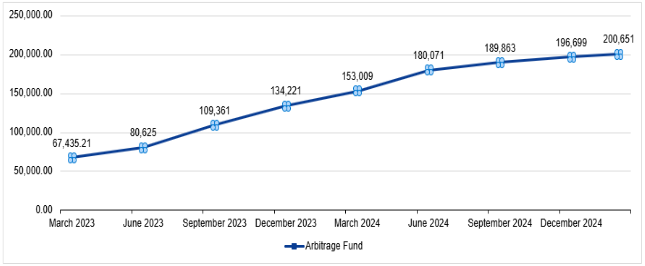

Post removal of indexation benefit of Debt Mutual Funds, Arbitrage funds have received significant inflows from investors. Gains from Liquid Funds are taxed at Slab rate while Arbitrage Funds qualify for taxation similar to equity-oriented funds (20% short term capital gains tax if redeemed before one year and 12.5% if redeemed after one year)

Source: AMF

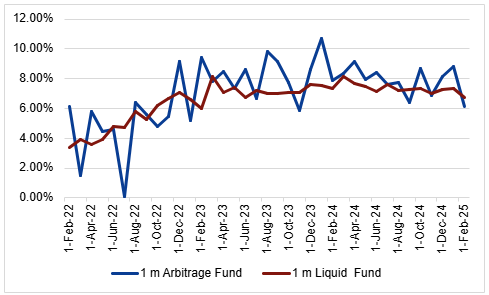

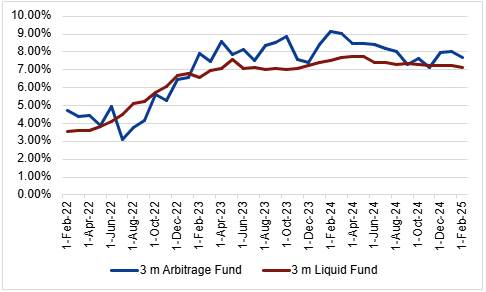

Arbitrage returns can be volatile in the short run (less than 3 months):

Arbitrage yields are more volatile because they are dependent on dynamic factors like market liquidity, transaction costs, price corrections, broader economic and regulatory changes, etc. and all of which can fluctuate quickly. Liquid funds, which invest in short-term debt instruments are less volatile.

The 1 month and 3 month rolling return of both the fund in the below chart shows the volatility of arbitrage fund returns which evens out in the medium term

Source: ICRA MFI Explorer (Annualized average Rolling returns of 5 schemes for 3 month and 1 month rolling one month basis)

The average rolling returns of both arbitrage and liquid Funds over the three-month period are almost similar, making the arbitrage fund more tax efficient over liquid funds. However, one month rolling returns has volatility which investors with short-term goals should be mindful of.

Exit load: Arbitrage funds have higher exit loads if redeemed quickly and are suitable for investments with a time horizon of more than 3 months. In contrast, liquid funds are designed for safer, short-term parking of funds, with lower exit loads if redeemed within a brief period, usually 7 days.

Expense Ratio: Arbitrage funds have higher expense ratios due to the complexity of their strategies, their intensive risk management and the infrastructure required to execute trades efficiently. Liquid funds, by contrast, have relatively less operational demand, leading to lower costs.

Arbitrage funds may be more suitable for investors in higher tax brackets with an investment horizon of at least 3 months and who do not mind some volatility in returns.

On the other hand liquid funds are more suitable for investors with shorter investment horizons or those in lower tax brackets due to their lower expenses, stability and liquidity. Ultimately, the choice depends on an investor’s financial goals, risk appetite, and investment horizon.

Disclaimer: Views are personal

Statutory Disclaimer:

https://amc.ppfas.com/schemes/riskometer-with-media-disclaimers/