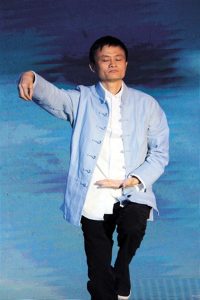

I recently presented on the Alibaba Group & its founder Jack Ma (lovingly known as Crazy Jack) at FoF. While reading about the culture of the firm, it was obvious that they’re heavily influenced by their founder’s love for martial arts and historical Kung Fu Fiction. It’s so much woven into their culture, that Jack Ma’s nickname in the company is “Feng Qingyang” which comes from a character, who is a reclusive, unpredictable & aggressive swordsman.

It reminded me how much I enjoy watching martial arts films. It connected instantly to the memories of watching Jackie Chan & Bruce Lee films when I was a kid.

There’re several things we can learn from martial arts. Apart from the awesome, choreographed fights, the philosophy of martial arts is also worth exploring. Martial arts are known to force the fighter to stop, assess & judge the situation & then exert the appropriate amount of energy in the right direction, only when it’s needed. That’s why it’s a very apt metaphor to describe the process of investing.

Let’s look at some of the basic tenets of Martial Arts:

Preparedness

A martial arts master needs to map his/her limitations in the event of a fight. To achieve that the master has to train regularly and build a database of muscle memory. Most of the shortcomings can be weeded out with careful practice & continuous development.

An investor faces quite the same situation. Some external events do tend to create gaps in valuation which an investor can take advantage of. The investor has to consistently build his database of knowledge to understand various businesses & industries to be prepared for such an opportunity. Like the martial arts master who never seeks out a fight, an investor must also never seek out action just for the sake of it.

Alertness

Through their rigorous training the martial arts masters have honed their reflexes to stay alert in all situations. The best offence might be the element of surprise, but the best defence is to not be surprised at all & remember your training.

An investor also needs to be aware of how things are changing in the environment. Being alert helps the investor to act when everyone is still figuring out what happened.

Decisiveness

Decisive blows can quell the best attack. Just as the martial arts master trains to land blows in various scenarios, over time it becomes second nature. It becomes a reflex & the master doesn’t have to remember his training consciously during the fight.

An investor who is well prepared & alert can show phenomenal decisiveness in investing at the right time. Without the courage of the training & hours put in to build the knowledge base, the decisiveness will be hollow & eventually confusing.

Adaptiveness

When we are prepared, alert & decisive in our actions, we can quickly adapt to situations. Bruce Lee’s famous words – Be water – apply very well to the dynamic nature of markets or a street fight.

Rectitude

Knowing martial arts is a great responsibility. It has the potential to destroy but at the same time it has constructive uses like building confidence & character. The training for martial arts is rigorous and demanding (remember Pai Mei’s training in Kill Bill Vol. 2). It instills discipline and its teachings can make the mind accept the destructive nature of the art & helps a master to control it.

Active Investing, in the same way, can be very destructive for our financial health if we are not disciplined in building our own rules of risk management. Some people add an ethical layer to the speculative nature of the market by not participating in certain situations or trades.

Routine & Focus

The previous tenets won’t work if the mind is not routinely engaged. The martial arts masters train regularly on a daily basis at specific times to make sure they stay sharp & build incrementally, rather than hope to become elite performers overnight.

To paraphrase Bruce Lee – I’m not afraid of the man who knows ten thousand different kicks, but I’m afraid of the man who has practiced one kick, ten thousand times.

An investor must devote a lot of cognitive power to build a routine of looking at specific data to build cases for investing. Without this, there would be no incremental improvement to the knowledge base and no observable improvement in the process. Routinely sparring with an investment partner can be as useful here as it is in martial arts. A skilled opponent can teach us more about our gaps in understanding than any excel sheet which we have populated with numbers ourselves.

Diversity

As a martial arts master, we can’t afford to just know what’s happening in our school of martial arts. To be a skilled fighter we must devote some time to study ways of other martial arts to learn from their processes & see how a new form can fit with ours.

Investing in isolation and with a single school of thought has it’s own benefits, but no good investor worth their salt, can deny a positive evolution in their own thought process over decades spent listening & watching other investors think. It is sometimes useful to see how other thoughtful people are thinking about the world & improve our views.

That’s not all, there’s a lot of content an investor can go through on the net, but there’s very limited good quality content to start learning about the philosophy of martial arts.

Here’s something to get you started –

Kung Fu Quest 1

Kung Fu Quest 2

I also found the book The Art of Learning by Josh Waitzkin, very illuminating, which speaks about the efforts needed to build a mindset for learning & adapting.

Hirendrasingh Chauhan

Very Nice Article & Very Well Articulated,