No one has ever trained for an incident like that.

– Captain Chesley “Sully” Sullenberger (Sully, 2016)

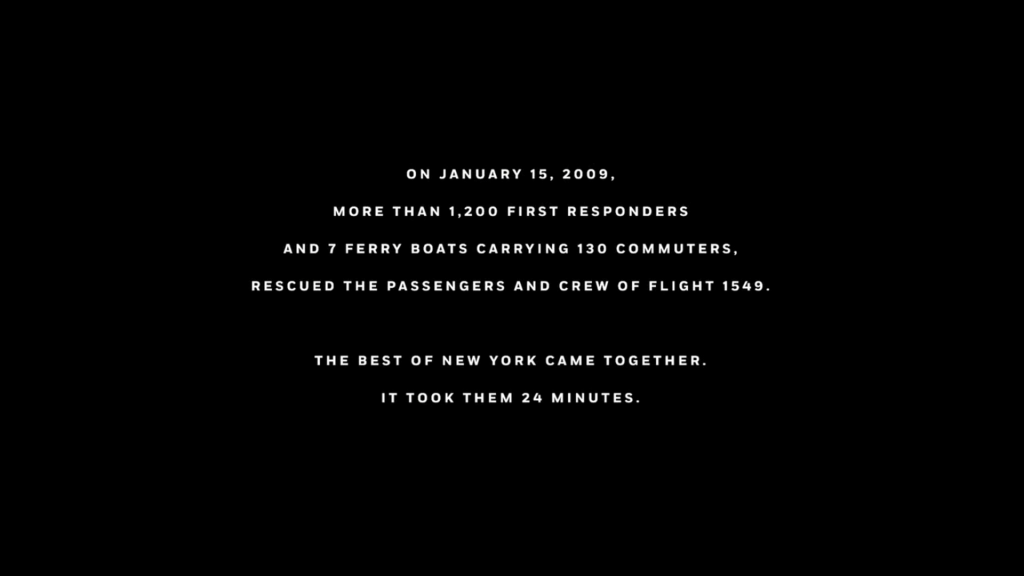

I watched the film Sully, recently. It’s a story about something that happened in USA, why should it really matter to us? After watching the film I realise how much we underrate the importance of the infrastructure that is around us. In direct relation to the film, The safety board, the aviation unions, the emergency services, the ATC crew, the flight crew. The image, sourced from the film, attests to the fact that it does take a collective effort to make things work smoothly.

Things around us seem to run automatically, but there is always some human being & some system which makes sure that it’s running the way it’s supposed to be running. In the unfortunate event when the thing doesn’t work the way it should, we get to look inside. We get a glimpse of that hidden system that makes it work. Just like a human body which works until it doesn’t and then we need to see a doctor to get the system back together again.

So what holds this system together? It’s governance, economics, the legal system, the human capital, the physical & digital infrastructure & the most important of all, trust. Trust that each part of the system will do its intended job to make sure the other parts can perform smoothly.

As an investor, if you’re curious & observant enough, you’ll get to notice these inner moving parts of the system of the economy that you’re most interested in. You’ll be able to deduce the way it works & predict a possible future outcome. Of course, things may not go as planned. Captain Sully didn’t begin that day thinking of landing in the Hudson River nor does any investor invest with a hope that it makes a loss. It’s fascinating how this film captures the true nature of investing better than any films made on the field of finance.

It captures the nature of the investor’s mind, the kind of the balance between objectivity, experience & intuition needed to make a decision on which their life savings are relying upon. Like a pilot’s role, it’s not a role that one takes on carelessly. The calm demeanour, the focus & the research needed to understand something so closely is a responsibility not to be taken lightly. In fact, the promoters and the entrepreneurs have spent their lives in knowing & operating their businesses & they’re bound to make errors of judgements either because of their lack of attention, or a genuine mistake. We as investors need to appreciate the prudence required to assess these possible successes or failures of these businesspeople to carefully curate a portfolio of good businesses.

Investing has sadly become a very public profession & rightly so for retail oriented investment vehicles. The amount of scrutiny an investment manager faces can arguably be detrimental to the self-confidence of the manager. It is part of the profession & must be embraced. In an event you do make a mistake, & you will, the only focus, like the Captain Sully in the film, must be on finding out what really went wrong and how to avoid it without getting buried under all the social/emotional/personal load.

All investment cases are different for different investors. This is an important fact that must be recognised by anyone who is investing. It’s hard not to get emotional & it’s hard to stay objective.

Like the fictional Captain Sully says, “No one has ever trained for an incident like that.”

Leave a Reply