A lot has been said about cloning in investing but a lot is left unsaid. Cloning is interesting because it exposes us to new investment ideas. Cloning becomes dangerous when we use it to clone someone’s process.

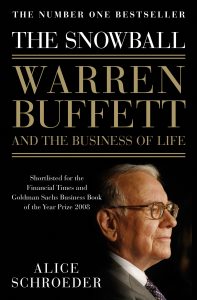

I spoke about Investing with Conviction at October Quest 2017. I recounted my experience about reading Alice Schroeder’s Snowball.  I read about 10% of the book & realised that it went in too much detail about Warren Buffett’s personal & family life. It described at length, his situation & financial circumstances while growing up. In the part I read, it hardly contained any investing principles or Buffett’s approach to investing. It soon became a disappointing experience. I kept the book back on the shelf. A while later I narrated my experience to an investor friend of mine. I told him how the book didn’t teach anything about investing like Buffett.

I read about 10% of the book & realised that it went in too much detail about Warren Buffett’s personal & family life. It described at length, his situation & financial circumstances while growing up. In the part I read, it hardly contained any investing principles or Buffett’s approach to investing. It soon became a disappointing experience. I kept the book back on the shelf. A while later I narrated my experience to an investor friend of mine. I told him how the book didn’t teach anything about investing like Buffett.

He was wise enough to urge me to go back & finish the entire book cover to cover. Had I not listened to his advice I’d have perhaps deprived myself of a very important investing lesson.

After finishing the book & reasonably absorbing myself in Buffett’s life story I figured that it’s useful to learn how other people think & process ideas. It’s almost impossible to be able to mimic their process, even marginally well.

From the book it is pretty evident that Buffett’s investing process is driven by his personal circumstances while he was growing up; the economic era he was born into & the kind of influences he picked up. Similarly each of us are endowed with our own life stories that are uniquely capable to shape us as the individuals that we are. Why rob ourselves of the chance of becoming our own kind of investor?

Performance & Process

Social networks & media end up glorifying investors based on their performance but hardly anyone gets commended on their process. Process is hard to see, results are hard to hide. The irony about the coverage of process is that no one wants to cover a process that has not delivered results in the recent past, no matter how well it has performed over the long term.

When the whole world is obsessed about Sharpe ratio of the portfolio it’s important to understand what sort of risks are accepted while investing. Accepting the probability of known downside is part of the process. This leads to portfolio allocation & position sizing, which in turn drive the results.

Just like some answers are hard to find, there are also some questions that are hard to ask without understanding the investors’ circumstance & background, well.

Literary Learnings

I think the process used for teaching literature is very apt here. Literature students not only read books written by the authors but also understand the author’s background & socio-political circumstances under which they wrote. There is a remote chance that such kind of effort will be put in to dissect an investor’s process.

For all the time spent in studying an author’s background it enhances the depth of the reader’s appreciation for that work of art. For every hour spent in studying an investor’s background is an hour that continues to remind us that we can’t really mimic those circumstances.

Just like living in the same situation as a prodigious author doesn’t automatically turn us into a literary genius, even if we were born on the same day as a great investor, the paths taken will rarely be the same.

Krishna Appala

Always great to read your articles Ronak. Please do keep them coming.

Sahil Kalariya

Can i get a link to read all of “THE TORTOISE SPEAK”. I mean in PDF or Word File.

I don’t want to miss any of this value Articles.

Please share.

Thank You.